GST FAQs on Registration

GST FAQs Series Part - 1

GST FAQs Series:

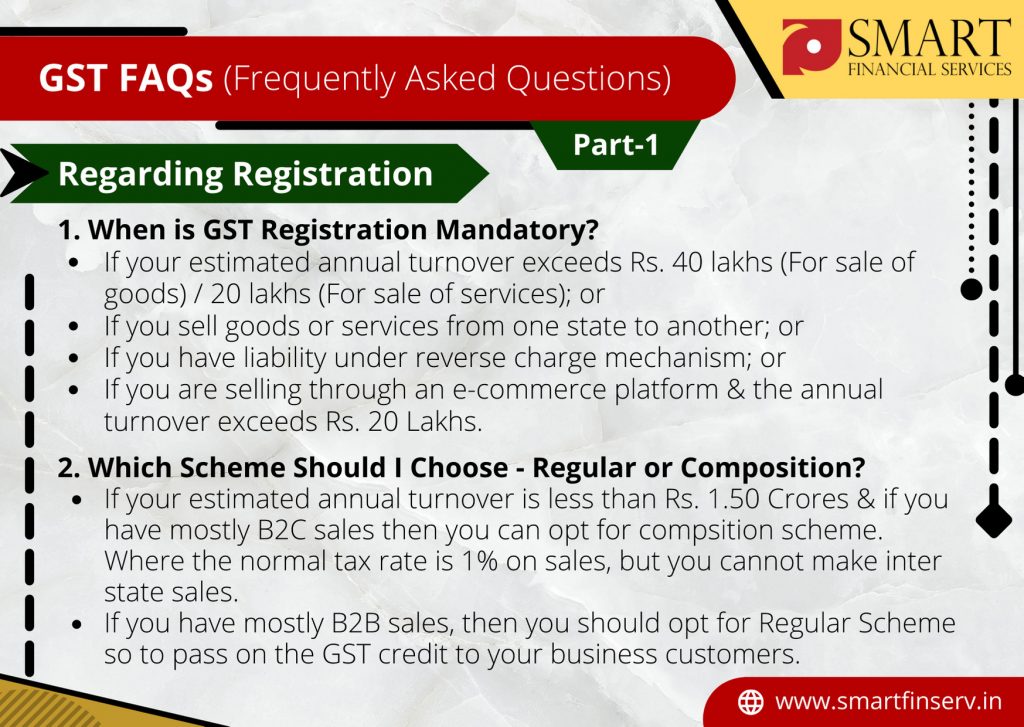

Starting a new Series of posts for Frequently Asked Questions regarding GST and its answers in simple language.

In this 1st part of GSTFaqSeries we will be discussing FAQs relating to GSTRegistration.

To get similar updates on Whatsapp click here!

Update:

The threshold of Rs. 20 Lakhs is applicable even in case of inter-state rendering of services!

Get your business registered under GST!

Get tailer-made solutons based on you business's requirements!

Contact Us!Shyamal Modi

He is a Practicing Tax Advocate having 5+ years of experience in Accounting, Direct & Indirect Taxes, Corporate Filings and other related fields.

Share on facebook

Share on linkedin

Share on twitter

Share on whatsapp

Copyright © 2021 Smart Financial Services

Designed by illimiteTouch Pvt. Ltd. | Images created by freepik – www.freepik.com