TCS on Sale of Goods

Section 206C(1H)

Are you liable to collect TCS on sale of goods under the provisions of Section 206C(1H)?

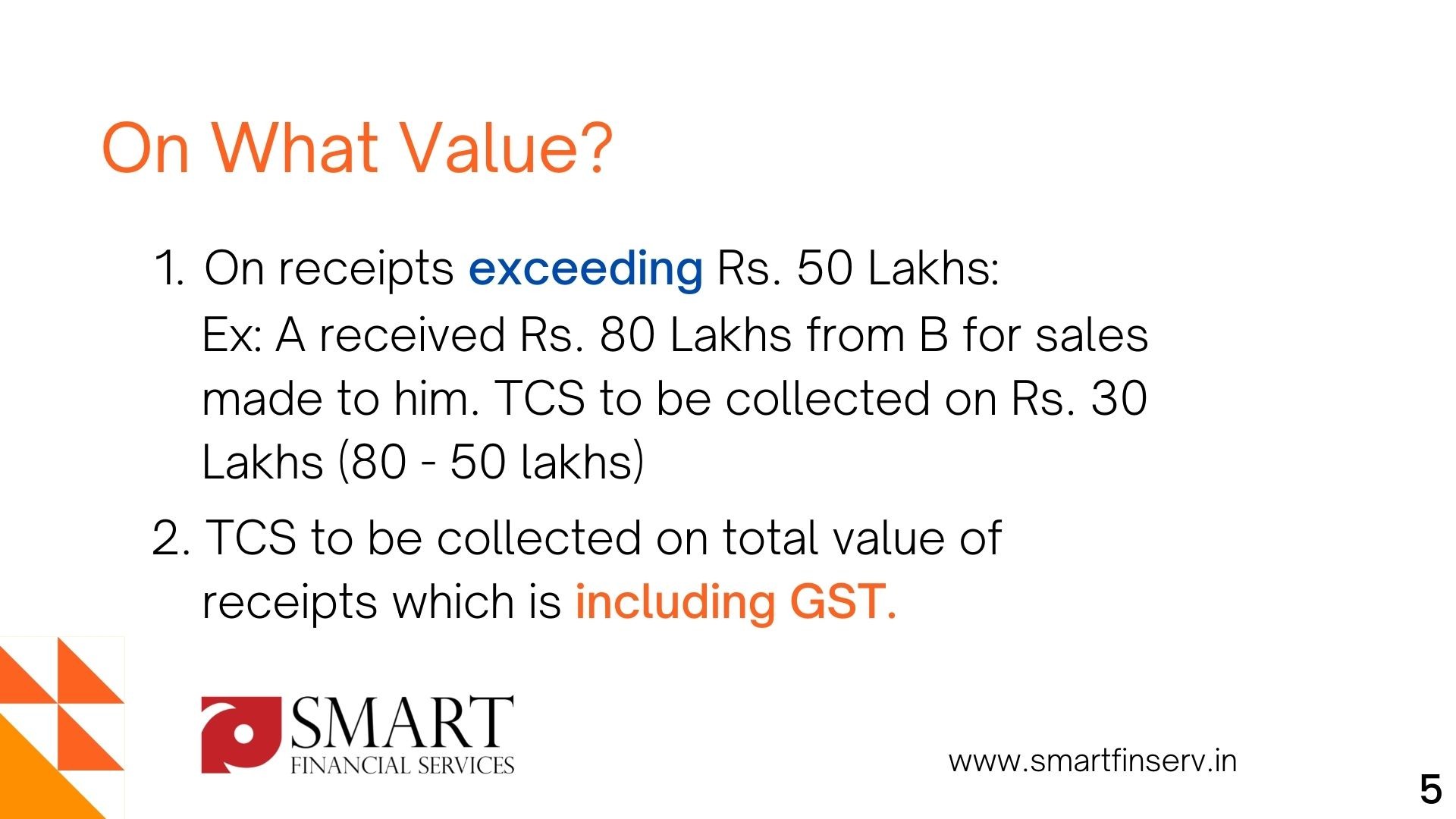

This section was introduced by FM in the last year’s budget 2020, which is applicable starting from 1st October 2020. Where, any seller of goods (only goods – services are not included!) shall be liable to collect TCS @ 0.1% on receipts from buyer exceeding Rs. 50 Lakhs.

This section was brought into the picture primarily for bringing all such persons into the ambit of tax, who are liable to file Income Tax Returns but are not filing, or are not disclosing correct income particulars. If tax is collected on such high value transactions, they cannot escape from filing of income tax returns, as government shall have data regarding purchases made by them which in turn give an idea about the volume of buyer’s business. Even to claim refund of TCS collected one has to file return disclosing proper income details. The whole idea of TDS & TCS provisions is to increase tax collection and reduce loopholes for tax evasion.

To avoid taxing the same transaction twice, the Government said, if Section 194Q applies to a specific transaction, where Section 206C(1H) also applies, then Section 194Q shall prevail. Which means TCS u/s 206C(1H) shall not be collected on such transaction as TDS shall be deducted.

In simple words, TCS under this section shall not be collected where, buyer is liable to deduct TDS under any other provision of this Act on such transaction.

Read on the slide to get insights on this section in easy to understand language!

Let us see few examples to understand this section better:

Example 1: Hemganga Ltd. had aggregate receipts of Rs. 1 Crore from Cocher Marbles Ltd in current year against sales. Hemganga Ltd. had turnover of Rs. 8 Crores in FY 2020-21. Will TCS be collected?

Ans: No! As the turnover of Hemganga Ltd. Is less than 10 Crore, it doesn’t fulfill the 1st Condition. Hence, TCS provisions of Sec 206C(1H) shall not be applicable.

Example 2: Rehan Industries received Rs. 45 Lakhs from Sindane Ltd. in current year against sales. Rehan Industries had turnover of Rs. 12 Crores in FY 2020-21. Will TCS u/s 206C(1H) be applicable?

Ans: No! As the threshold of Rs. 50 Lakhs has not crossed! (2nd condition)

Example 3: In continuation to above example, what if Rehan Industries also received Rs. 30 Lakhs against sales from Augusta Solutions Pvt. Ltd.? Will TCS be applicable?

Ans: No! As the threshold of Rs. 50 Lakhs is applicable to individual party and not on total sales.

Example 4: Sanjiv made received Rs. 75 Lakhs from Shardul against sales made this year. His turnover in last FY was 25 Crores. Should Sanjiv collect TCS u/s 206C(1H) for this receipts? On what value?

Ans: Yes! As Sanjiv meets both the conditions (1.Having T/O more than 10 crores in Last FY; and 2. Receipts exceeds Rs. 50 Lakhs in Current FY) He has to collect TCS on the amount exceeding Rs. 50 Lakhs i.e. on Rs. 25 Lakhs (75 – 50 Lakhs).

Example 5: Last year (FY 2020-21) Renuka Industries made sales worth Rs. 5 crore to Jubilant Industrial Works Ltd. of which Rs. 40 lakhs were outstanding at the end of the FY. As Renuka Industries aggregate turnover was more than 10 Crores in FY 2019-20, they had collected TCS on the receipts. In FY 2020-21 their total turnover was 15 crores. Should Renuka Industries collect TCS in current year (FY 2021-22) on receipts of Rs. 40 Lakhs?

Ans: No! As the threshold of Rs. 50 Lakhs is available each year! TCS shall be collected only after aggregate receipts exceed the threshold limit.

Example 6: In continuance to above example, if Renuka Industries’ aggregate turnover in FY 2020-21 is less than 10 crores, should TCS be collected if receipts exceed Rs. 50 lakhs? Note: they were liable to collect TCS in FY 2020-21!

Ans: No! TCS should be collected only if both the conditions are met. Both the conditions should be checked each year for the applicability of this section!

Is this section applicable to your business? If yes, contact us for filing your TDS & TCS returns on time!

Shyamal Modi

Copyright © 2021 Smart Financial Services

Designed by illimiteTouch Pvt. Ltd. | Images created by freepik – www.freepik.com